30,000 Foot View of a CPG Brand

The Background

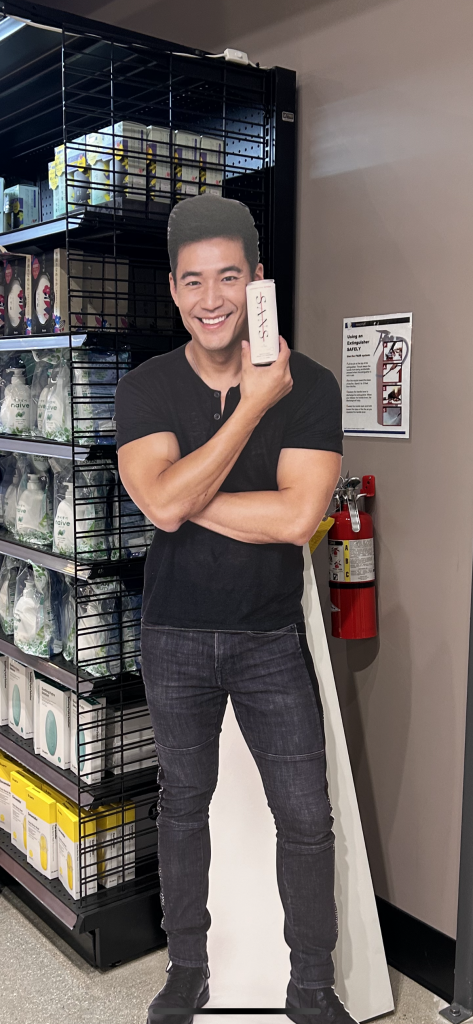

Kevin Kreider (Netflix’s Bling Empire) was a former personal trainer, male model, and reality show personality. Kevin has opened up about his struggles with alcohol. Once Kevin became sober, one of the challenges for him was going out and being social while having options for alcohol substitute beverages. Other than high-caloric and high-sugar juices or sodas, there weren’t too many options – so he created SANS. SANS has two taglines: ‘A Conversational Beverage’ – this is meant to position SANS as a social drink, and ‘Be part of the buzz, without the booze.’

I watched the show, Bling Empire, and thought what Kevin was doing was interesting. At that time, I was thinking about starting my own non-alcoholic beverage brand. Unlike Kevin, I didn’t have any issues with alcohol, but I saw a similar gap in the market. I spent months researching and planning to create my own beverage brand. It occurred to me that perhaps I should just partner with someone like Kevin who was still in their early stages, but a few steps ahead of me. I approached Kevin and his co-founder, Doug, about possibly working together.

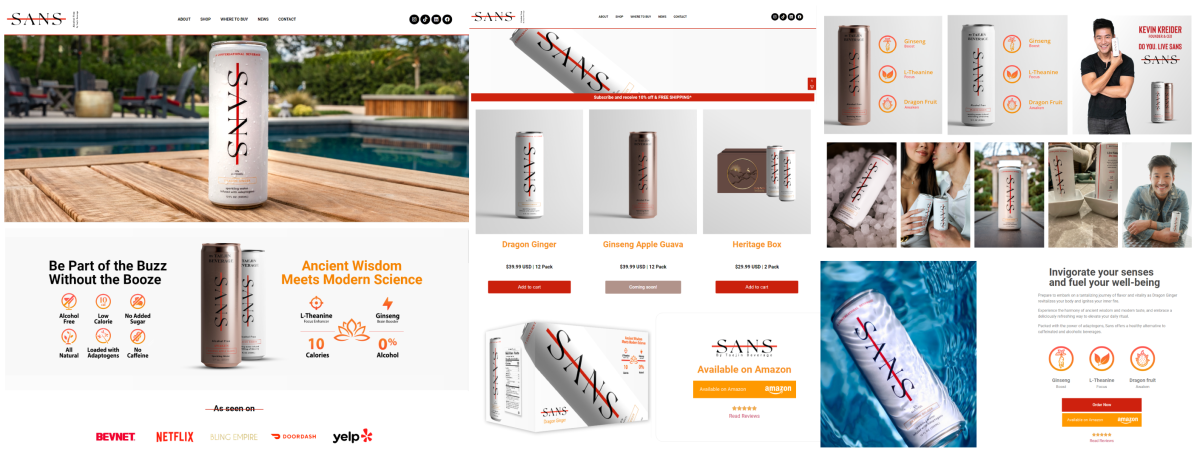

They had an immediate need for a new website so they brought me on for that one project. Their existing Shopify site was very basic. Instead, they wanted something more sleek, modern, and that would better represent their vision, which was to create a luxury beverage brand for the sober and sober-curious market. They also needed their new site to be live in 2 weeks to coincide with the launch of their new flavour – Ginseng Apple Guava.

I spent the next few weeks designing and building a custom site on WordPress with a Shopify integration. At the end of that engagement, I was invited to join the SANS team as their CMO.

The Challenges

- Strategic leadership – they didn’t have a marketing leader who could guide them. Kevin didn’t have any experience as a Founder / CEO, nor running a marketing team. They didn’t have a MarTech stack, didn’t have any process, didn’t have regular strategy meetings or any strategy playbooks, didn’t have any goals that were written down…

- Positioning – they had an identity crisis – they didn’t know who their ideal customers were beyond people who consume non-alcoholic beverages. They hadn’t built personas or had any strategy on which channels and markets they wanted to go after. They had looked at the competitor landscape, but didn’t have a strategy about their competitor advantage, where they fit into the market, what their customers care about, where to find their customers, and how to win them. They were in a handful of retail spaces and restaurants in Los Angeles, but most of those were based on Kevin’s network. Other than running some Amazon ads, posting on Instagram, and doing in-store demos, their marketing was pretty limited.

- Budget – they were operating on a shoestring budget with a lean team. This severely hindered their growth potential. They were looking to do a fundraise, but until then, their hands were tied due to budget constraints.

- Awareness – While Kevin launched the brand on a hit Netflix show, in which he developed a social following, that was many years ago, and the show had since been pulled off Netflix. Kevin hasn’t maintained the same level of relevancy, and as a result, his star power and influence have declined considerably.

The Solution

Upon joining as CMO, and knowing about their challenges, my goals were to:

- Be more data driven

- Be more process & goals driven

- Be more strategy driven

- Define the branding and positioning

- Build more awareness

- Market expansion

I started by looking at the data – I wanted to know all the different sales channels, and which ones were most effective (and why), and which were the least effective (and why). They had three main sales channels:

- Digital (website & Amazon)

- Retail (grocery)

- Restaurants

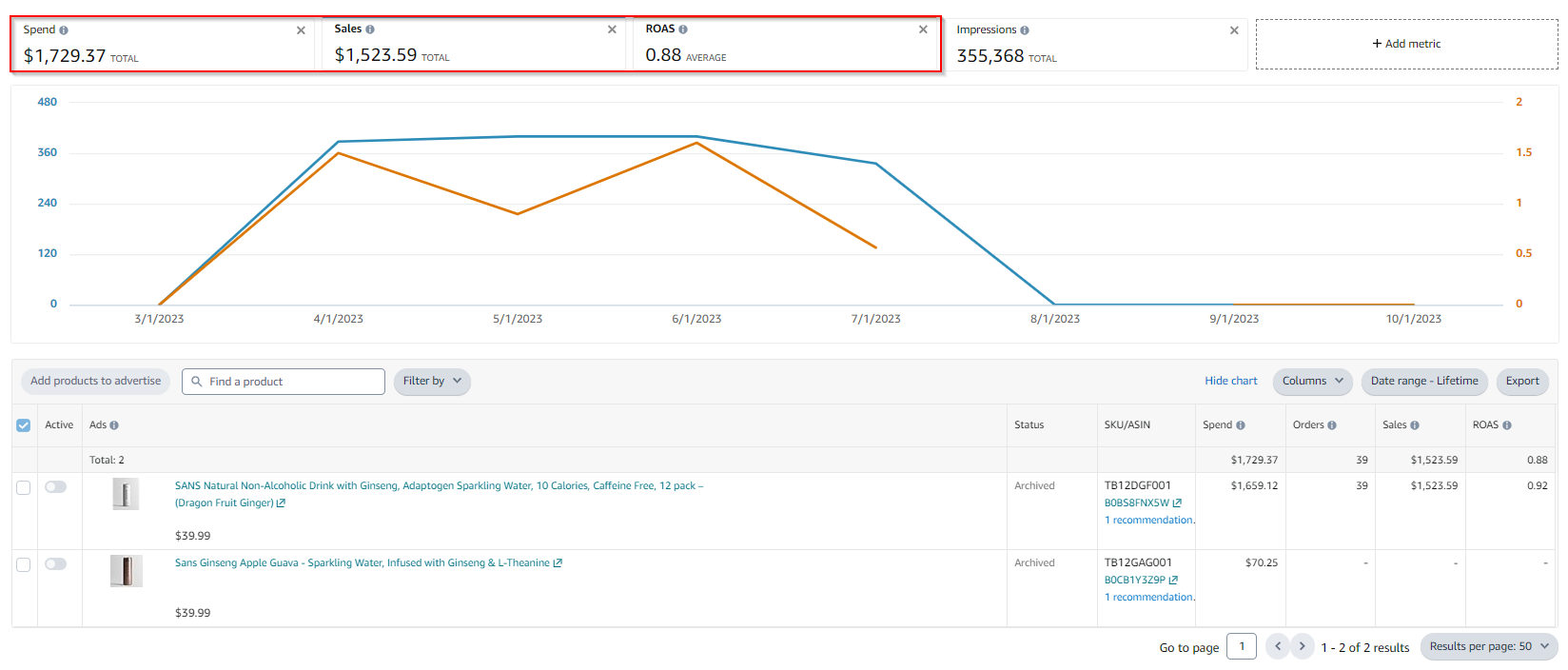

Digital – They were running some Amazon ads, but weren’t that effective. Since this channel was money leaving the business, I needed to look into that immediately. What I discovered, unbeknownst to them, was that for many of their campaigns, their ROAS was 1 (or below 1). This means that for every dollar they spent, they would get one dollar back, or less than one dollar. Thus, making Amazon, in its current state, an ineffective sales channel from driving profit and scale.

As it turned out, the keywords that were driving the most sales were branded keywords. In other words, customers were going to Amazon to buy SANS, typing in “SANS”, clicking on an ad, and then making a purchase. They would have made these sales without the ads.

Seeing this, I cut their ad spend to zero on all branded keywords so that they could earn a profit on those branded searches.

I continued to look through the data and discovered a handful of non-branded keywords that had higher ROAS so I created new ‘competitor takeout’ campaign targeting those products only. As part of revamping the Amazon strategy, I also built their Amazon store, which they previously didn’t have, along with redoing several graphics, which would elevate the brand. However, Amazon took a large percentage of our profits so I recommended we not invest too much into it as a sales channel.

Instead, I suggested we focus on retail and restaurants largely because:

a.) it’s where people go to consume or purchase beverages

b.) there’s a discoverability factor where we can earn a sale without paying for advertising costs

To this end, we hired a Sales Director who had prior experience and relationships in retail and restaurants to help us get distribution faster than us doing it on our own.

Retail – The data also revealed that retail dropped off a cliff, specifically with Erewhon. I inquired into what was the explanation of this sudden drop and nobody had an answer. I recommended we speak to Erewhon and ask if something had changed on their end. We found out due to an error, SANS had previously benefited from being placed near the front of the store in a favourable location among the single serve ready-to-drink beverages. At some point, Erewhon recognized this error and moved SANS to the non-alcoholic section, which was tucked away in the back of the store. As a result, sales plummeted. This further cemented the idea that we have a positioning problem.

Restaurants – Restaurant sales were also low. The harsh reality was that SANS had been riding a wave of momentum from Bling Empire and Kevin’s celebrity, but that was quickly dwindling. Bling Empire had been cancelled three years prior and had since been removed from Netflix altogether. Kevin hadn’t done anything on the scale of Bling Empire since. So unless you’ve seen the show, you may not even know what SANS is. So when a patron sits down at a restaurant and see ‘SANS’ on a menu, that means nothing to them. Some questions we had to ask were:

a.) are customers even looking at the drink menu, or do they already know what they want?

b.) are they looking at the non-alcoholic section, which is where SANS was located?

c.) seeing the name “SANS” on a menu without prior knowledge of the brand, would that be enough for them to order it?

The answer to all three is likely, ‘no’. We needed to change that.

- We needed people to think about SANS as their go-to drink when they sit down at a restaurant.

- We needed to move SANS out of the non-alcoholic section and have it sit next to ice teas and sodas on the regular drink menu.

- We needed to educate restaurant patrons what SANS is very quickly.

To solve for these challenges, I recommended changing the name to SANS Sparkling Water and asking restaurants to move our placement on the drink menu.

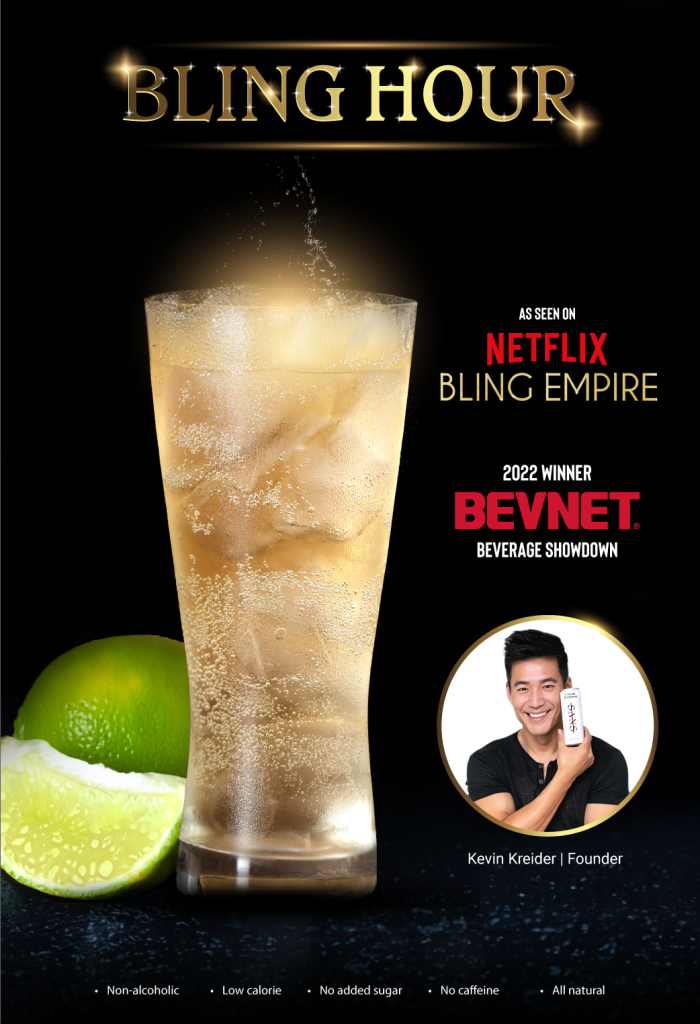

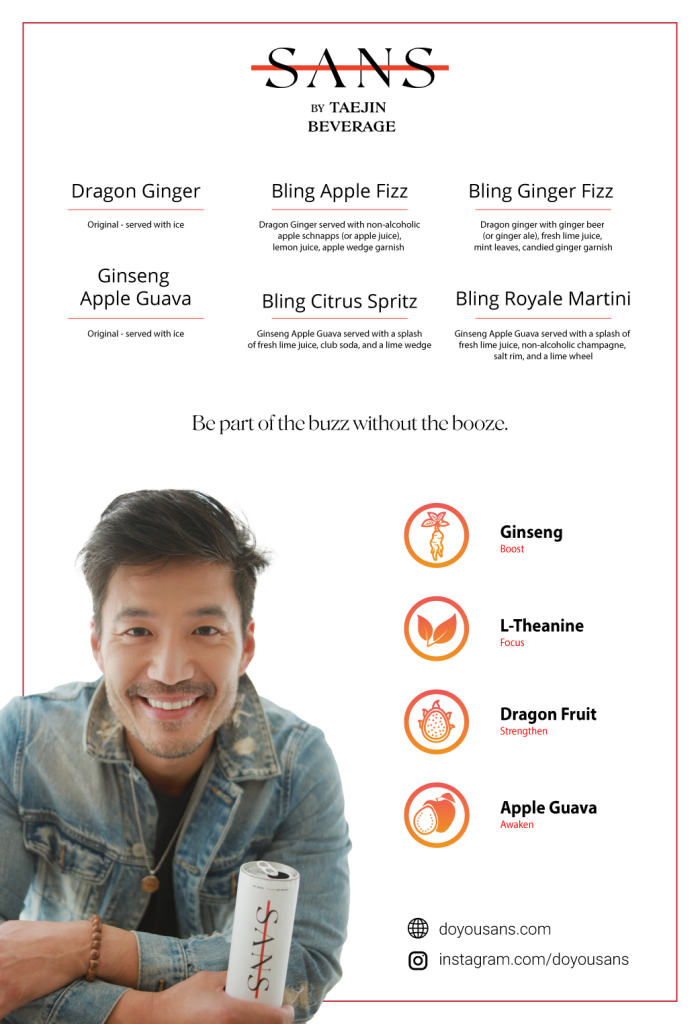

I also created table and menu inserts with three different SANS mocktails (i.e. Bling Apple Fizz, Bling Ginger Fizz, Bling Royale Martini)…, along with a promotion – “Bling Hour”. Unfortunately, we were unsuccessful at having any restaurants implement this.

It was obvious we had squeezed everything out of the Bling Empire promotion and we needed to start marketing to a broader audience. However, with no budget and limited staff, that was going to be tough.

Process & Goals – if you don’t where you’re going, how will you know when you’ve arrived? The SANS team seemed to be passively floating along, chasing whimsies which ever way the wind blew that week. There was no process and no goals.

I implemented weekly meetings where each department head had a chance to present what they were working on, and what, if any, blockers they had. I also introduced them to Asana, where tasks could be organized by project, and owners and deadlines would be assigned along with priorities. We could also use Asana asynchronously to communicate with each other and provide any status updates as needed. The meetings were to be run through Asana as well so that we could all align and know what everyone was working on. I also created several new Channels in Slack so that we could stay more organized and find previous threads more easily. Replies needed to be contained within the existing threads and not started on a new thread so that people could follow along the discussion more easily.

I tried to establish S.M.A.R.T. goals with every department head to keep us focused on a set of unified goals. Unfortunately, this was never implemented.

Strategy – SANS was conceived to be an alcohol substitute, but it also had some functional ingredients in the formulation – L-theanine, Ginseng, no added sugar, no caffeine, low calorie.

I suggested we lead with the functional benefits. We can still be a non-alcoholic beverage, but we should also position ourselves within the ‘better-for-you’ / or functional category, which is much larger and easier to target.

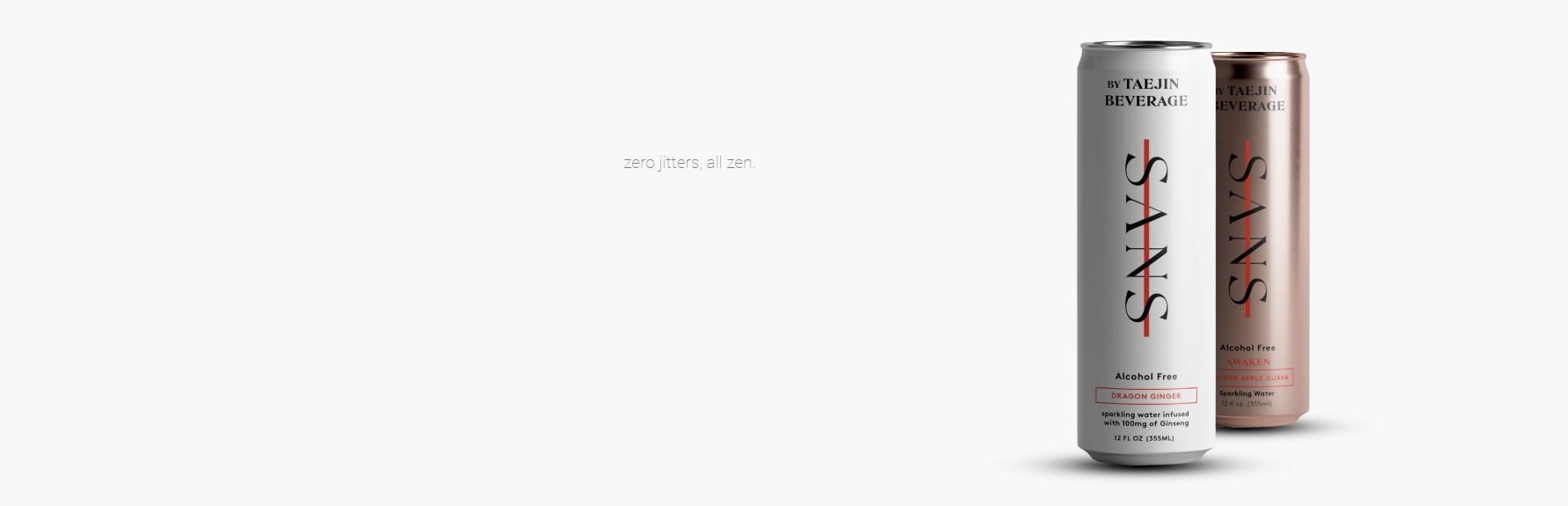

I added a lot more information about the ingredients on the website and came up with a new tagline ‘Zero Jitters, All Zen’. I even started a blog where we would write about the health & wellness crowd. The topics for the blog were identified through keyword research and planned out in a comprehensive content calendar.

The founders really wanted SANS to be a “luxury brand”, but didn’t fully comprehend what that meant for the brand.

First, we needed to define our terms so we can align on the vision. What does it mean to be a luxury beverage brand? There’s a difference between premium and luxury. Premium (i.e. Lululemon) is high-quality, elevated price, but still within the realm of affordability for most people. Luxury (i.e. Louis Vuitton) is more aspirational and unaffordable for most people. To be a luxury brand, the brand often needs one or more of the following:

- Legacy status – been around for decades

- Superior craftsmanship

- Superior materials

- Not mass produced (made by hand)

- Exclusive

- Expensive

None of these apply to SANS – in fact, it’s not even a premium brand. Going through this exercise, we further defined what we mean by “luxury”. We want a brand that caters to the luxury market, has a luxury aesthetic, and is associated, or has partnerships, with luxury brands.

This helped us think more strategically about the idea of being a luxury brand. Perhaps we shall approach luxury stores (Van Cleef & Arpels, Louis Vuitton, YSL, etc.), luxury hotels, have partnerships with luxury brands (i.e. Mercedes Benz, Oppenheim Group), work with luxury influencers, and showcase more of a luxury aesthetic on the packaging, social, and website. Perhaps we could do a partnership with a high-end hotel – create an exclusive black can, have it come in a high-quality box, and include a dust bag.

Each one of these ideas was further refined into a strategy playbook. We also used this discussion to define one of our ideal customer profiles – the luxury consumer.

I also suggested we make SANS more of a lifestyle brand that had clothing, celebrity collabs, and exclusive limited-edition drops.

In addition to the luxury market, we defined several other personas. One of which was the health and wellness crowd. I suggested we partner with a high-end gym in Los Angeles, ‘The Dogpound’, where celebrities and models are known to frequent. We could do an exclusive flavour that can only be purchased there. Similar to the clothing idea, I wanted to activate user-generated content and free advertisement. For a company with limited budget, we had to think creatively about building brand awareness at scale.

Market Expansion – as part of our market expansion efforts, I wanted to move beyond Los Angeles. I suggested Vancouver, but that created much more challenges than choosing another US city. We settled on Las Vegas. We began making steps to be distributed in various restaurants, hotels, casinos, and venues in Las Vegas.

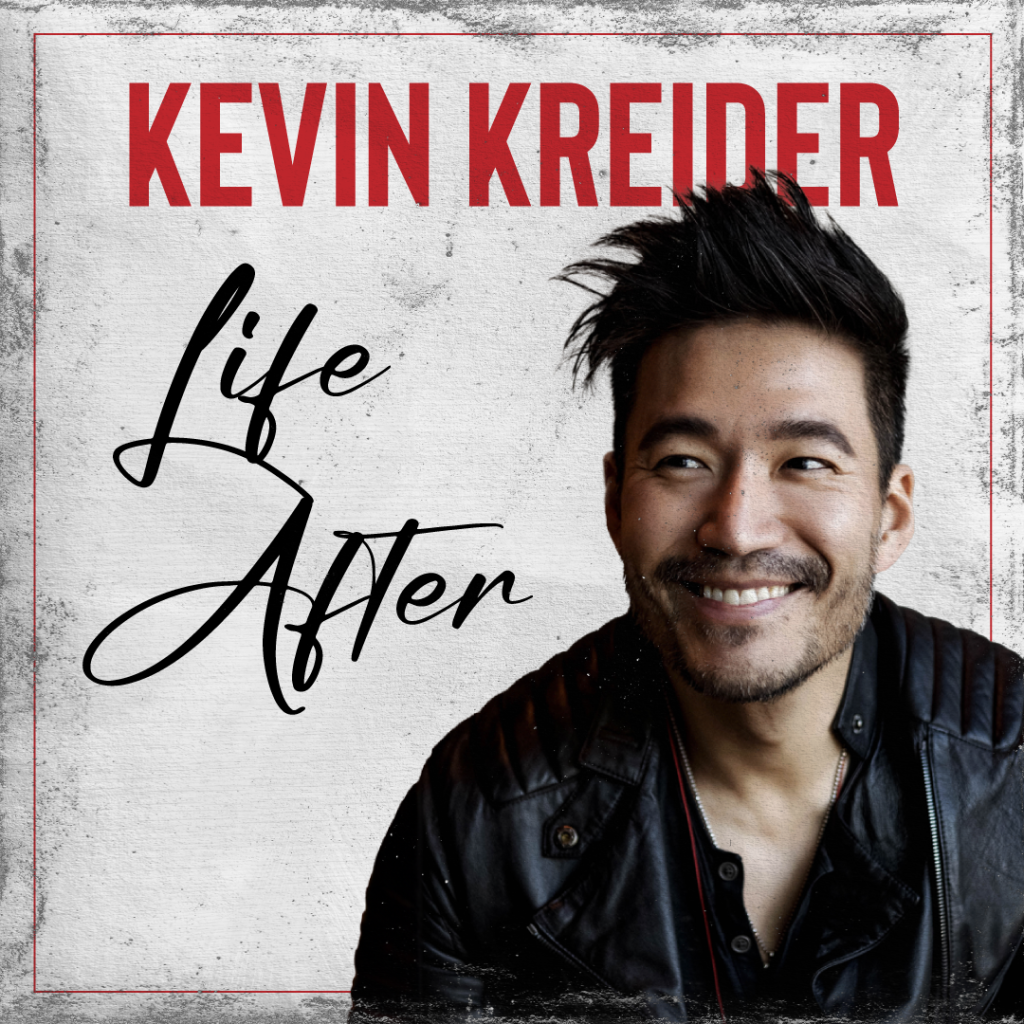

Utilizing Kevin – I wanted to tap into Kevin’s celebrity and push him more into the spotlight. We had him show up to demos, write blogs, be more active on social, be a guest on other people’s podcasts, and even start his own podcast, in which I conceived and designed the cover art. I built out an entire list of potential guests and we started reaching out to them to invite them on. I also edited Kevin’s blog posts and his videos to ensure they aligned with the brand and maintained a high standard.

Social Media – I created an entire social media strategy and calendar, where we focused on the content pillars, content type, channels, cadence, etc. All this was much more thoughtful and structured than what they had done in the past.

Campaigns – I launched our first campaign during Black Friday where we offered a discount on our Ginseng Apple Guava flavour. I created all the graphics, which were on the website, social banners, social posts, ads, and even an aggressive email campaign.

Our second campaign was launched during Christmas. Again, I led the campaign, created all the assets, and even made some videos for social.

We had plans to bring SANS to Vancouver to coincide with Chinese New Year, and I helped strategize and design the limited edition can (name changed to SANSI for legal reasons).

As part of the reband, I also redesigned the sell sheet and the investor deck.

Before

After

The Results

Marketing is all about figuring out who are your ideal customers, what do they care about, and how to most effectively reach them. Then it’s about doing the right activities, consistently, over time.

The resulting efforts from the work I did for SANS created a much more structured and process-driven company that better understands where they fit in the market. Their brand identity is now defined and consistent across all channels. From colours, to fonts, to imagery… everything is intended to exude a luxury brand aesthetic while still being competitively priced in the market.

There’s still a long road ahead for SANS and plenty of more work left to do. At the time I wrapped my engagement with them, it was too soon to see any notable lift. Afterall, there’s only so much one person can do without any budget. So time will tell. However, I believe I set them up on the right path toward success.